Three UK Endorses Which? Campaign to Make Fraud a National Priority

Three UK has joined Which? in a coalition representing some of the UK’s biggest banks and telecoms providers to make a landmark commitment to urge the new government to make fraud a national priority.

The group, which also includes Barclays, BT, Mobile UK, Nationwide, NatWest, Starling, UK Finance, Virgin Media O2 and Vodafone, is calling on ministers to provide the leadership necessary to ensure more businesses can better share intelligence to detect fraud and to protect their customers.

The sharing of fraud intelligence is key to getting ahead of organised crime groups that can blight the lives of so many consumers. Fraud accounts for around 40 per cent of all crimes in England and Wales, and figures from UK Finance revealed that criminals stole over £1 billion through unauthorised and authorised fraud last year.

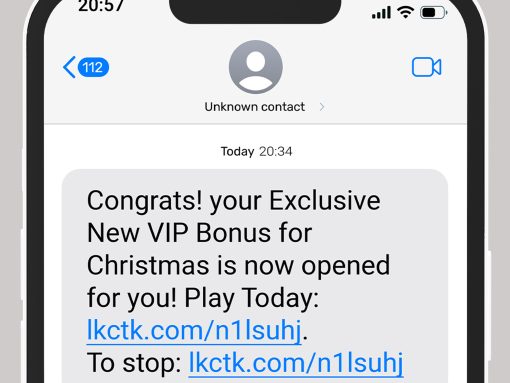

However, the group is concerned that individual companies, law enforcement agencies and government are not working collaboratively enough to share information on how fraudsters can exploit gaps in their systems. This allows scammers to deploy the same tactics consistently across multiple channels.

The coalition believes that by sharing fraud indicators businesses will have more information to help them recognise an attack before it happens, meaning customers will be better protected.

The barriers that deter business from sharing data are created by worries of breaching data protection regulations and competition concerns. The government can tackle these barriers through scaling up existing efforts, setting standards and clarifying guidance to legally share data. Without overcoming these barriers, industry faces a painfully slow, costly and high-risk approach to an environment where fraudsters flourish with high-speed tactics.

The coalition is calling on the new government to:

- Make clear that tackling fraud is a national priority and is essential to its wider crime strategy;

- Put in place central leadership able to coordinate initiatives across government to deliver a joined up approach to tackling fraud;

- Lead the taskforce to share fraud data, which must work across industry sectors and deliver technical solutions to generate a data application that can be used to prevent fraud across UK digital channels.

The signatories stand ready to join the taskforce with the specific purpose of sharing the data they are collecting, and consuming data from other sectors to be used in their fraud prevention processes to benefit all UK consumers.

Mark Fitzgerald, Director of Finance & Fraud at Three UK, said: “With fraudsters always coming up with new tricks to target our customers, we are joining Which? in its call for the new government to make the terrible crime of fraud a national priority. We hope that we can work with businesses from across the industry to fight the issue and make sure our customers are protected.”

Rocio Concha, Which? Director of Policy and Advocacy, said: “Fraud continues to blight the lives of so many consumers across the country, with devastating consequences both financially and emotionally.

“For too long, the actors that will be part of the fight to combat this terrible crime have been operating in silos – so this commitment from banks and telecoms providers to work together to share data is a significant step forward in the right direction.

“We urge the new government to make fraud a national priority and to ensure that businesses can share data and best practices with each other to bolster their defences and ultimately keep their customers safe.”